3D Printing Trends: Six Major Developments

Today, time is our most precious commodity. Competitive pressures and evolving business models mean companies must shrink development cycles to innovate and implement new ideas with speed and agility. With a new class of better-performing machines, more materials available and greater ability to deliver 3D printed parts that are true to their mechanical properties, 3D printing proven itself to be a significant time- and cost-saving option for design and manufacturing.

From its conception, 3D printing has had the potential to change the way goods are manufactured. The benefits have strategic implications: flexibility, design freedom, time-to-market, mass customization, distributed manufacturing and much more. Although challenges remain, the results of using 3D printing are demonstrating their value.

Over the past several years, Jabil has sponsored three 3D printing trends surveys to enable us to explore where additive manufacturing is headed and current realities. Our 2021 survey contains insight from more than 300 participants responsible for decisions around 3D printing at manufacturing companies and reveals the experiences and opinions of professionals who are "in the trenches." These respondents come from a wide variety of industries—including electronics, plastics and packaging, industrial machines, automotive, healthcare and more—which give us a full picture of the 3D printing market and how additive is being used.

Download the 2021 survey report to learn about the current state of the global 3D printing market.

1. Use Cases for 3D Printing Are Skyrocketing

While three decades of 3D printing may not seem particularly long in comparison to traditional manufacturing methods, additive manufacturing has been highly transformative in a wide range of industries.

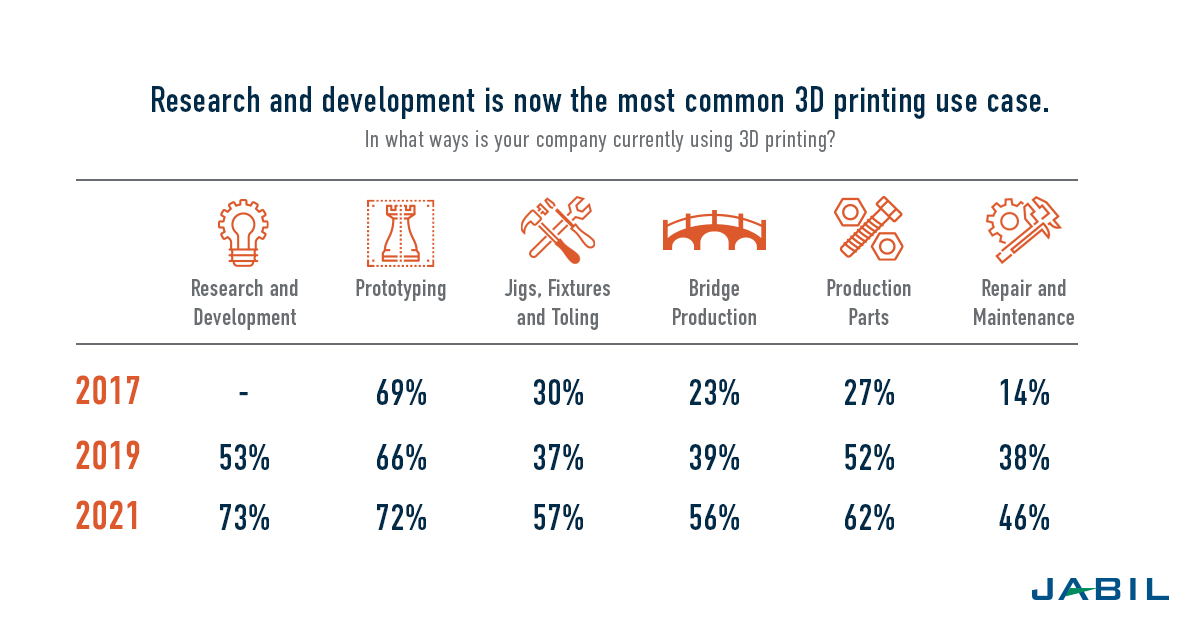

The results we've gathered in the last two studies contrast sharply with the information we gleaned in our first survey back in 2017. Even in just the past two years, 3D printing use skyrocketed. Our research clearly demonstrates an upward trajectory of the popularity and applications of additive manufacturing.

In 2017, when our participants responded to how their companies were using 3D printing technology, the most popular answer (by far) was rapid prototyping. At the time, nearly seven out of 10 respondents affirmed using 3D printing for this purpose. No other option even came close in popularity; only three in ten selected the runner-up (jigs, fixtures and tooling). Since then, use-cases have soared.

Today, research and development surpassed prototyping as the most popular 3D printing application and every other use case has dramatically increased. The percentage of companies leveraging additive manufacturing to build production parts and jigs, fixtures and tooling has roughly doubled since 2017 and use for production parts has nearly tripled.

Close to 100% of participants say they use 3D printing to produce functional or end-use parts. Of course, the levels at which they do varies. Almost 80% report using additive manufacturing to produce at least 25-50% of their functional or end-use parts.

The strides made in 3D printer technology are empowering companies to experiment with previously impossible 3D printing applications. As the cost for 3D printers decreases and the speed at which they can help a company scale mass production increases, they will become more accessible to transform the entire manufacturing industry.

2. Growth Projections for the 3D Printing Industry are Higher Than Ever

The outlook for the future of 3D printing is extremely positive. The manufacturing stakeholders involved in decisions around 3D printing expect significant growth. Ninety-seven percent of manufacturers polled expect their use of 3D printing to grow within the next five years.

Most participants said they expect their company's use of 3D printing to at least double in the timeframe. Nearly half expect their use to double, while almost four out of 10 expect the increase to be dramatic (five times or more). In addition to the growing acceptance of the practice industry-wide, once again, the accessibility of the technology will drive this growth.

How do you expect your company's use of 3D printing to change in the coming 2-5 years? Choose the answer that most closely applies.

While companies aim to grow their overall 3D print capabilities, expectations are set high to use it for production parts or goods. A little over 80% of respondents expect their additive manufacturing use for production parts to at least double within the next five years.

3. Brands are Enjoying a Wide Range of 3D Printing Benefits

When we conducted our first survey, many of the benefits were still intangible concepts. But with the increased use and applications we've observed in the last few years, these are now proven realities, and survey participants are even more excited about the benefits of additive than they were two years ago. We've outlined the top three benefits companies report enjoying thanks to additive manufacturing.

What benefits do you expect to gain from mass adoption of 3D printing for manufacturing? Choose all that apply.

This recent rise in optimism toward 3D printing may not be a coincidence as we've leaned on additive manufacturing to survive the COVID-19 crisis. As the pandemic spread, companies with 3D printing capabilities jumped into producing and scaling much-needed but all-too-scarce medical personal protective equipment (PPE), such as respirators and face shields. In developing new diagnostic equipment and testing kits, 3D printing helped safely speed up the prototyping and design process.

Survey respondents chose the ability to deliver parts faster as the top benefit of additive manufacturing. We've seen this play out in our own experience; in fact, wanting to forgo the time-consuming, iterative process of going back and forth between tooling and design was a driving factor for our Auburn Hills facility to start using additive manufacturing to meet their tooling needs. Not only did this help them accelerate the manufacturing process but by printing the exact geometry they needed (as opposed to cutting away excess material), they were able to cut costs. In fact, they saved 30-40% on tooling and 80% on delivery time.

"Every aspect of the process has been significantly improved by having this [3D printing] ability within our facility," John Wahl VI, tooling engineer at Auburn Hills, concluded. "The first being time, the second being more creativity, the third being cost, fourth being materials."

When we looked at the data by job level, we discovered that executives are more optimistic about the benefits of 3D printing than team managers. Since executives are the ones casting visions (and planning budgets) for the company's future, this supports the indications that 3D printing will continue to grow.

4. Accessible 3D Printing Material Options are Surging

Since 2019, we've seen a dramatic increase in the 3D printing material types that companies are using. Although plastics/polymers still reign supreme, other materials have taken great strides in catching up. This corresponds with our finding that use cases are increasing.

When it comes to primary usage, the discrepancy between plastic and metal 3D printing isn't as big as you might think. More than a third of respondents answered that they use plastics and metals equally, and even between those who selected either plastics or metals, plastics led by just a little over 10%.

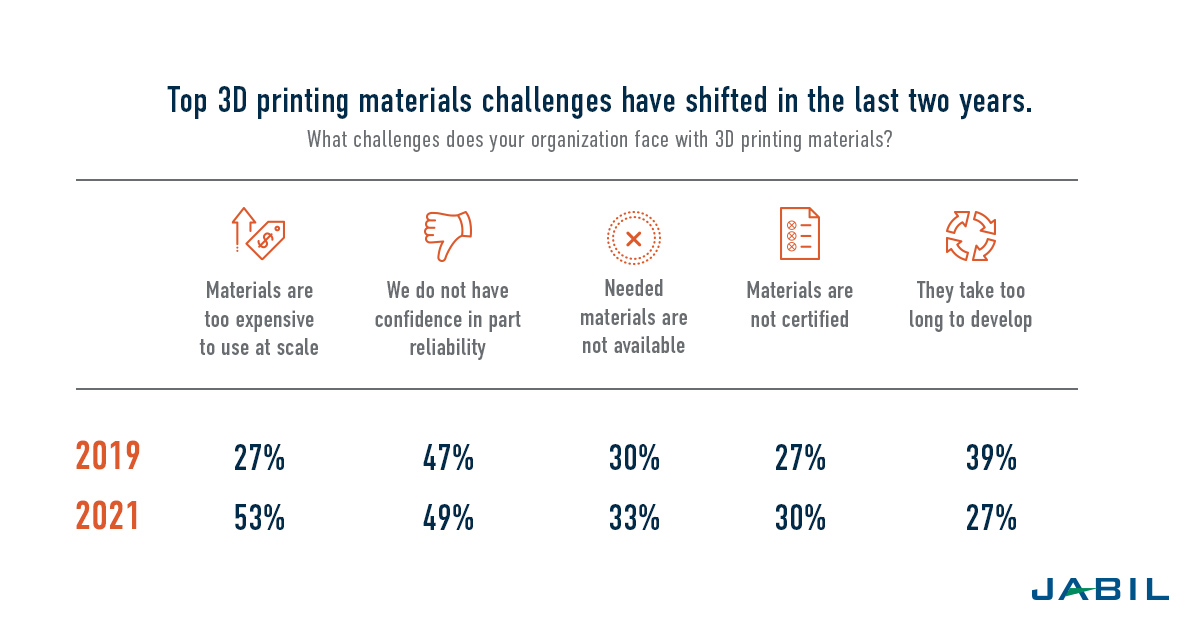

Of course, there are still challenges to overcome before some materials become fully accessible. More than half of respondents noted that the materials they need take too long to develop, almost double the percentage as 2019. A slightly elevated percentage of respondents also said that certain materials are too expensive to use at scale, necessary materials are unavailable and materials are uncertified.

But when those challenges are overcome — or alleviated — interest in different 3D printing materials is high. When we look at what materials are currently using compared to what they want to use, plastics remain the top choice. However, the desire to use almost all other materials surpasses the current use. Most noticeably, the desire to use glass surpasses current usage by 20%; desire to use ceramics exceeds use by 14%; and interest in metals surpasses current use by 10%. Based on these findings, it will be interesting to see how additive material usage evolves in another two years.

5. Companies Still Need to Solve Problems with Additive Manufacturing

Despite the optimism for growth in additive manufacturing, organizations have yet to solve all the challenges with 3D printing. Whereas almost half of 2019 respondents listed "cost of materials" as an issue, only about two-fifths did this year. Few challenges rise significantly above the others; most hover around 40%.

What challenges does your organization face with 3D printing? Choose all that apply.

However, many of the existing problems are related to cost, which makes sense since 95% of respondents reported financial barriers to additive manufacturing. Obtaining the appropriate qualifications and certifications is number one, but capital expenditures associated with machines and having to gain in-house expertise closely follow.

The top challenge in 2021 was the cost of pre- and post-processing. It does appear that companies are branching out in their pre- and post-processing methods. In 2019, a little over half of respondents said that they were using machining; now, almost three-quarters of respondent are, dethroning polishing as the most popular option. Considering that all processing methods increased significantly, it may be that companies are experiencing some growing pains and these challenges will lessen as companies continue to make this a priority.

6. Companies Are Prioritizing In-House Expertise

Currently, about three-quarters of survey participants are doing their additive manufacturing in-house. Considering that half as many survey respondents selected "lack of in-house expertise" as a challenge compared to the 2019 survey, we can assume that companies are prioritizing either educating their employees about additive manufacturing or hiring personnel with previous 3D printing knowledge and experience.

This doesn't mean that businesses are opposed to outsourcing their additive manufacturing; in fact, almost 100% indicated that they would consider this an option. When examining potential manufacturing partners, companies take a wide range of criterion into account. Design capabilities top the list but ability to scale, pricing and experience all follow closely behind.

What are your most important factors when selecting an outsourcing partner for 3D printing? Choose up to three of the following.

From the 1950s to the 1980s, the U.S. manufacturing industry relied on low-tech labor that was powered largely by human strength and stamina. Since then, we've come a long way, from human-made to human-and-machine-made. 3D printing is becoming steadily integrated into the whole supply chain.

In some areas of the 3D printing industry, we're still seeing a steep incline in growth. In others, we're seeing gentle increases. Four years ago, companies saw little use for 3D printing beyond fast and inexpensive prototyping; not many companies relied on additive manufacturing for full-scale production. But in just four years, we've seen that start to change, and as we solve issues around additive manufacturing materials and use-cases increase, 3D printing is sure to take many product industries by storm and show more market growth. It may not happen in dramatic leaps and bounds, but additive manufacturing is growing steadily - and it's here to stay. This is the world of digital manufacturing.

Download the 3D Printing Technology Trends Report

Jabil's third biennial report includes insights from over 300 individuals responsible for decisions around 3D printing at manufacturing companies on technology adoption, opportunities and challenges.

Jabil Additive Manufacturing

Click 'Learn More' to explore all of Jabil's Additive Solutions.