Digital Disruption in Healthcare: It’s About Time!

Major market forces are dramatically changing the landscape of an industry that has historically been deliberate and methodical in its adaptation to change. The disruptive dynamics and digital technologies being unleashed into this market have set up an unprecedented environment for creating industry leaders and laggards. Now, more than ever, healthcare companies need to adopt more thoughtful product development and supply chain lifecycle management practices to not only survive but grow and defend market share.

The Industry is Transforming and It’s Happening Fast

What exactly are the macro-trends that are disrupting healthcare’s status quo?

- Technological innovations are increasingly asserting their influence over the market.

- The shift in the United States to a value-based care (VBC) model, in which healthcare cost reimbursements are being driven by the efficacy of treatment.

- The entrance of non-traditional players to the marketplace, digitally native competitors eager to test-drive their expertise in the healthcare domain.

Although the healthcare sector may be moving slowly in its response to the digital disruption, the rewards will be significant for those who respond to this market with speed and agility.

Healthcare Needs to Adopt Consumer Tech’s Pace of Innovation

Safe, effective delivery of therapy and ensuring optimal patient care have long been the primary concerns of the healthcare industry. As a result, for much of its existence, product development and lifecycle management has been driven forward by a conservative and steady pace befitting the fulfillment of these concerns, resulting in product lifecycles stretching out as long as 10-15 years.

But today, increasingly, we are seeing that the reliance upon – and wedding of – technology into the product mix is altering traditional product lifecycle expectations. Healthcare products are behaving more like consumer products. Healthcare franchises are discovering that once their products become technology-dependent, they just can’t quit. This new dynamic is here to stay and needs to be managed moving forward. There is much to be learned from consumer technology, particularly within the automotive and transportation markets.

When buying a car today, people rarely base their purchase decisions solely on a vehicle’s ability to transport them—they’re not just checking under the hood or even kicking tires. What’s top-of-mind is how much cool new technology they’re going to have access to in their new set of wheels. They’re checking out the infotainment, connectivity, automotive imaging and advanced driver assistance systems. Getting the car in a favorite color used to be the deal-closer. Now it’s the question, “Does it come with CarPlay?”

Consumers enter the automotive market for the same basic reason that spurred the popularity of the Model T Ford – to get into something that will take them from point A to point B. But along the way in their collective buyer’s journey, they’ve become delighted by increasing innovations, ones which continually improve upon the delivery of that basic function.

In healthcare, the end-goal has always been to protect the patient and help improve patient outcomes. This has, historically speaking, anchored therapy as the primary driver of ongoing product iterations, with patient choice taking a back seat. But now, with the dramatic expansion in digital health platforms and other innovative technologies, the patient is increasingly having a voice in how that therapy is delivered.

For instance, in the diabetes domain, as the market has shifted to fuller adoption of interoperability standards, patients are increasingly being placed at the center of a highly individualized custom diabetes product ecosystem. No longer locked into a one-brand system, what’s to keep the consumer from mixing and matching, especially when presented with choices between older generation medical devices or ones with fresh, elegant and intuitive interfaces featuring the latest connected technology and analytics?

Today, what the market is telling us is that companies need to adopt more agile product management strategies. They need to iterate every two to three years, not once a decade, or risk losing market share. On top of that, they need to do this in a regulated market with a momentum that is increasingly towards a value-based model.

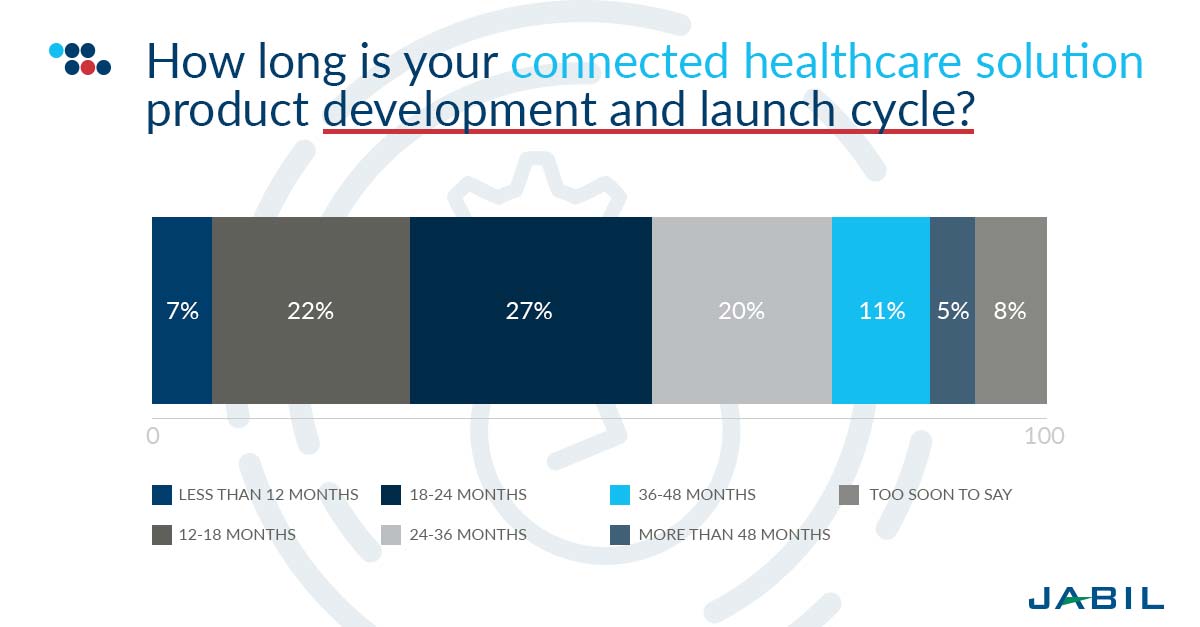

According to a Jabil survey on connected health technology trends, 71 percent of participants said that their healthcare product development and launch cycles are longer than 18 months, with 44 percent indicating they face timelines longer than 24 months.

In many ways, this lag in medical device production cycles is understandable. Data management and privacy issues certainly play a role in the hesitancy, but more impactful is the concern that process deficiencies may have life or death consequences. Over time, this has created an industry culture with an inherent cautious and careful DNA that can too easily bleed over into being so tradition-bound that virtuous skepticism becomes unhealthy, collaring productive dialogue and adoptions of positive change. But there’s so much digital innovation can bring to healthcare.

Meanwhile, consumer technology and automotive and transportation franchises have navigated accelerating product cycles brilliantly. Embracing modular design has allowed them to keep pace at the speed of innovation, which in turn has helped mitigate the risk of potential supply chain disruptions. Modular design creates a virtuous circle of feedback and revision, enabling the most traction for products in the market.

We are eager to share what has been made so apparent via pan-Jabil observations of these industries: those companies that work consistently and deliberately to inject adaptability, speed and modularity into their cultures are the winners in their markets.

So, what should healthcare’s CEOs, product directors, R&D and innovation managers be doing now to set themselves up for success?

This question and more are answered in our new Point-of-View (POV) paper—It’s About Time! For a More Agile Response to the Digital Disruption in Healthcare. Download the full POV paper.

Another central theme to the message is to recognize the opportunity presented by:

Innovative New Players Entering the Healthcare Market

Just within the last month, Alphabet has tapped former FDA commissioner, Robert M. Califf, to oversee health strategy and policy for its Verily Life Sciences and Google Health divisions. Califf made the following comment upon beginning an advisory role with the company a couple of years ago:

“Although we are in the midst of an explosion of capability in the worlds of computing and information, we are still learning how to translate this capacity into better health and healthcare. Bridging this gap has been a recurring theme of my career.”

It’s important to note this about companies like Google and other tech giants entering the healthcare market: yes, they are incredibly nimble competitors who are digital natives and eager to test-drive their expertise in the healthcare domain. And yes, they certainly bring great ideas and incredible new technology to the industry; however, these companies still have significant gaps and barriers in understanding the clinical and regulatory process. By and large, these new entrants are not inventing new therapies but enhancing what’s already available in the market. They’re much-needed catalysts driving healthcare innovation.

This is where the opportunity lies. These companies are (and will continue to be) willing to collaborate and partner with healthcare incumbents, so now’s the time to be proactive, not reactive, and to be receptive to the specialized insights and skills of others.

Digital Disruption in Healthcare: a Q&A with Jabil Executives

Industry Call-to-Action: Make Partnerships a Core Part of Your DNA

The point isn’t simply about inviting in technology expertise from other industries. The guidance here is more about opening up and reaching out to collaborators whose insights and experience will truly help unleash the power of agility into a company’s product management strategy.

Enlisting outside expertise is one of the most effective ways to solve challenges within a product solution ecosystem and helps ensure that a company’s development energies are divided strategically between Exploit versus Explore initiatives. Partners with fresh insights, talents and perspectives who are given license to fully embrace the task of identifying previously unknown risks and developing truly new solutions can help to identify trends in how markets will progress over time, which can then be tied to investment plans supporting product lifecycles.

It’s not surprising, given the dramatic impact of technology on the industry, that according to Jabil’s survey, the partners perceived to offer the most potential benefit are manufacturing companies with expertise in connected designs and devices.

Healthcare companies need to ask themselves qualifying questions, like this one:

Do your partners have the experience, competence and commitment to get you fully connected?

The best partnerships will take a comprehensive view of a company’s existing supply chain throughout the entire product lifecycle. Additionally, the partner will capture intelligence, assist in product roadmap development, understand domain and regulatory requirements and enable a company’s product strategy to move at the speed of technological innovation.

Value-based care is changing the rules. The acceptance of VBC in conjunction with rapid technology advancements are creating a paradigm shift in the healthcare and life sciences industries. It’s transforming every therapy domain in healthcare.

And as the speed of technology adoption accelerates, creating winners and losers, it begs the question:

Which side of the divide will you land on, and who will you rely on to get you there… and stay there?

Download "It's About Time! For a More Agile Response to the Digital Disruption in Healthcare" POV Paper

Seize the opportunities offered by this extraordinary inflection point in healthcare by empowering yourself with partnerships.